Featured

Table of Contents

- – Why do I need 20-year Level Term Life Insurance?

- – Why do I need Level Term Life Insurance Policy...

- – How do I compare Affordable Level Term Life I...

- – Why is Fixed Rate Term Life Insurance important?

- – What is the most popular Low Cost Level Term...

- – What should I know before getting Level Term...

Adolescent insurance supplies a minimum of security and could offer protection, which could not be offered at a later day. Quantities given under such insurance coverage are typically minimal based on the age of the youngster. The existing restrictions for minors under the age of 14.5 would be the higher of $50,000 or 50% of the amount of life insurance policy active upon the life of the candidate.

Juvenile insurance may be offered with a payor advantage rider, which offers for forgoing future premiums on the youngster's plan in the event of the fatality of the person that pays the premium. Senior life insurance coverage, sometimes described as graded death advantage plans, offers qualified older candidates with marginal entire life protection without a medical evaluation.

The permitted concern ages for this sort of coverage variety from ages 50 75. The optimum issue amount of insurance coverage is $25,000. These plans are normally extra costly than a completely underwritten policy if the person qualifies as a basic threat. This type of coverage is for a tiny face amount, commonly bought to pay the funeral costs of the guaranteed.

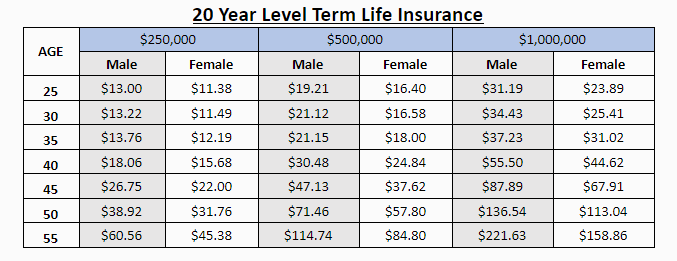

Our term life alternatives include 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most popular kind is level term, implying your settlement (costs) and payout (survivor benefit) stays degree, or the exact same, up until the end of the term period. This is the most straightforward of life insurance coverage choices and calls for extremely little upkeep for policy owners.

Why do I need 20-year Level Term Life Insurance?

For instance, you can provide 50% to your partner and divided the rest amongst your grown-up kids, a parent, a close friend, or even a charity. * In some circumstances the death advantage might not be tax-free, discover when life insurance policy is taxable

1Term life insurance policy uses short-lived protection for a critical duration of time and is generally less costly than irreversible life insurance coverage. 2Term conversion guidelines and restrictions, such as timing, might use; as an example, there may be a ten-year conversion privilege for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance Acquisition Alternative in New York. There is an expense to exercise this rider. Not all taking part policy proprietors are qualified for rewards.

Why do I need Level Term Life Insurance Policy Options?

We may be compensated if you click this ad. Advertisement Level term life insurance policy is a plan that gives the very same death benefit at any factor in the term. Whether you die on the very same day you obtain a policy or the last, your beneficiaries will obtain the very same payment.

Which one you pick depends on your demands and whether the insurance firm will authorize it. Plans can also last till specified ages, which in many cases are 65. Due to the fact that of the countless terms it supplies, degree life insurance offers possible policyholders with adaptable options. Past this surface-level info, having a higher understanding of what these strategies require will certainly help guarantee you acquire a plan that meets your needs.

Be mindful that the term you pick will certainly affect the premiums you spend for the plan. A 10-year degree term life insurance policy plan will cost less than a 30-year policy because there's less possibility of an incident while the strategy is energetic. Lower danger for the insurance provider corresponds to lower premiums for the insurance holder.

How do I compare Affordable Level Term Life Insurance plans?

Your family's age need to additionally affect your policy term option. If you have kids, a longer term makes good sense since it safeguards them for a longer time. If your youngsters are near adulthood and will be economically independent in the near future, a shorter term could be a much better fit for you than an extensive one.

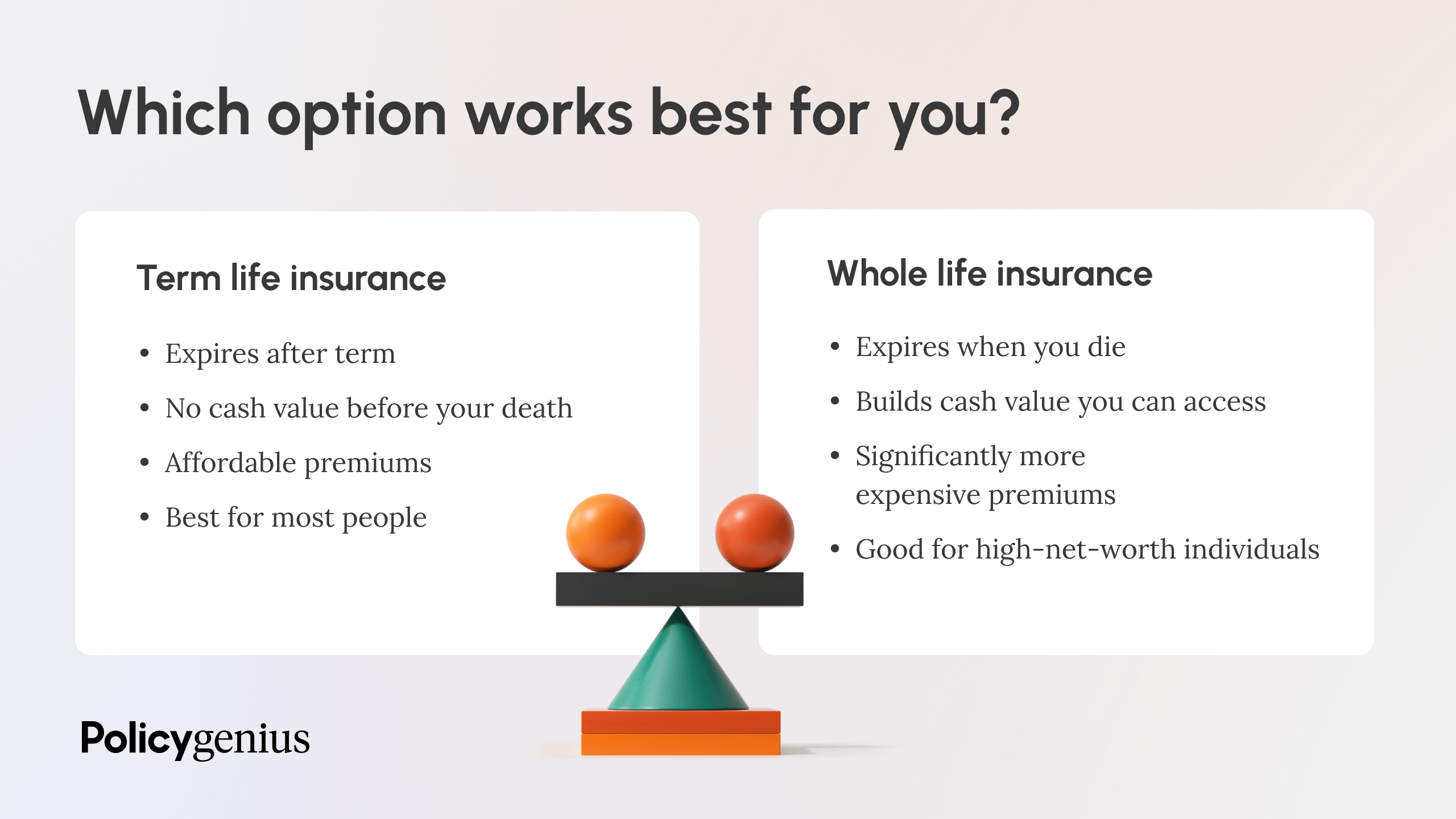

When contrasting whole life insurance vs. term life insurance policy, it's worth keeping in mind that the last normally costs much less than the former. The outcome is more coverage with lower costs, supplying the most effective of both worlds if you require a significant quantity of coverage but can not pay for a much more expensive policy.

Why is Fixed Rate Term Life Insurance important?

A degree fatality benefit for a term plan typically pays out as a lump amount. Some level term life insurance firms enable fixed-period repayments.

Rate of interest repayments obtained from life insurance policy policies are thought about earnings and go through taxes. When your level term life plan runs out, a few different things can happen. Some protection ends promptly without option for renewal. In other circumstances, you can pay to extend the strategy past its original day or convert it right into an irreversible policy.

The drawback is that your eco-friendly degree term life insurance policy will come with higher costs after its first expiry. Advertisements by Cash. We may be compensated if you click this ad. Ad For novices, life insurance policy can be complicated and you'll have questions you want addressed prior to dedicating to any plan.

What is the most popular Low Cost Level Term Life Insurance plan in 2024?

Life insurance companies have a formula for determining danger using death and rate of interest. Insurance companies have thousands of clients taking out term life policies simultaneously and use the premiums from its energetic policies to pay surviving beneficiaries of other policies. These firms use mortality to approximate the amount of people within a certain team will submit fatality cases per year, and that info is used to identify ordinary life span for prospective insurance holders.

Furthermore, insurance firms can spend the money they get from premiums and enhance their income. The insurance policy business can invest the money and earn returns - Fixed rate term life insurance.

The following section details the advantages and disadvantages of degree term life insurance policy. Foreseeable costs and life insurance policy coverage Simplified policy framework Potential for conversion to long-term life insurance policy Restricted protection duration No cash money value build-up Life insurance policy premiums can enhance after the term You'll discover clear advantages when comparing level term life insurance policy to other insurance types.

What should I know before getting Level Term Life Insurance Policy Options?

You always understand what to expect with affordable degree term life insurance coverage. From the minute you secure a plan, your costs will certainly never alter, helping you plan economically. Your protection won't differ either, making these plans effective for estate planning. If you value predictability of your payments and the payouts your heirs will certainly receive, this kind of insurance policy could be a great fit for you.

If you go this course, your premiums will raise however it's always excellent to have some adaptability if you want to maintain an active life insurance policy policy. Renewable level term life insurance policy is an additional option worth thinking about. These policies allow you to keep your existing strategy after expiration, providing versatility in the future.

Table of Contents

- – Why do I need 20-year Level Term Life Insurance?

- – Why do I need Level Term Life Insurance Policy...

- – How do I compare Affordable Level Term Life I...

- – Why is Fixed Rate Term Life Insurance important?

- – What is the most popular Low Cost Level Term...

- – What should I know before getting Level Term...

Latest Posts

Final Expense Department

Term Life Insurance Instant

Free Instant Whole Life Insurance Quote

More

Latest Posts

Final Expense Department

Term Life Insurance Instant

Free Instant Whole Life Insurance Quote